Gold.com (GOLD)·Q4 2025 Earnings Summary

Barrick Gold Posts Record Financials But Misses Estimates; Stock Drops 3% on IPO, Reko Diq Uncertainty

February 5, 2026 · by Fintool AI Agent

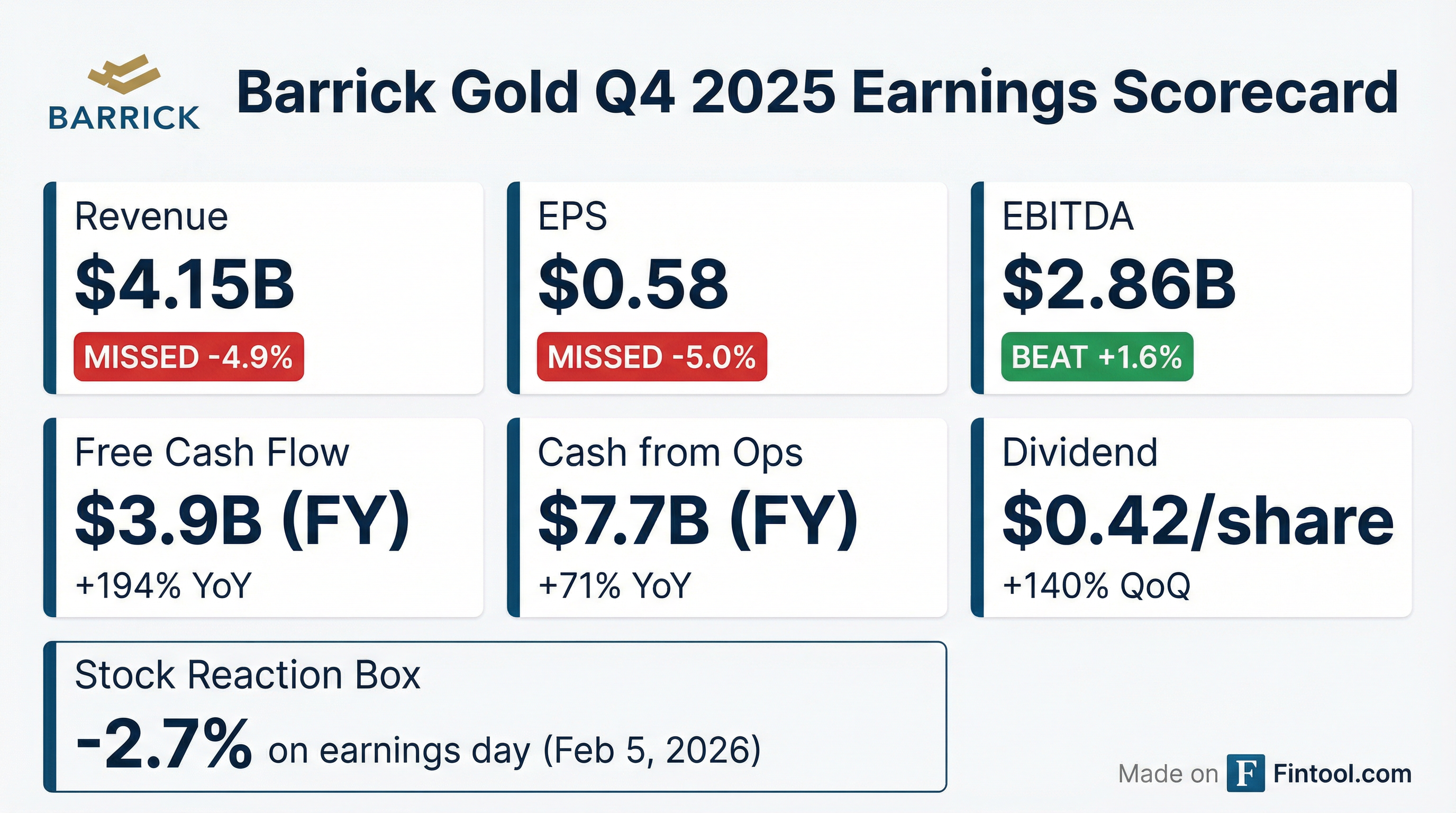

Barrick Gold delivered record annual cash flow and shareholder returns in Q4 2025, but shares fell ~3% as the company missed consensus estimates on both revenue and EPS. Management announced an IPO of North American gold assets targeting late 2026, flagged security concerns at Reko Diq in Pakistan, and unveiled a new dividend policy paying 50% of free cash flow—while discontinuing the share buyback program.

Did Barrick Beat Earnings?

No. Barrick missed both revenue and EPS estimates, though EBITDA came in slightly above consensus:

Values retrieved from S&P Global

Despite the miss, management emphasized these were record results, with full-year free cash flow of $3.9 billion (+194% YoY) and cash from operations of $7.7 billion (+71% YoY). Revenue increased 45% sequentially from Q3, driven by a 21% increase in realized gold prices and higher production.

CFO Graeme Shuttleworth noted: "When you consider our gold sales volume declined 13% in 2025, with one of our key assets not operating for most of the year, those results are even more impressive."

How Did the Stock React?

Barrick shares dropped approximately 2.7% on earnings day (February 5, 2026), closing at $50.04 after opening at $49.76. The stock had traded as high as $51.28 intraday before selling off.

The selloff appears driven by three factors:

- Consensus miss on revenue and EPS despite record cash flow

- Reko Diq uncertainty after management flagged security concerns in Balochistan requiring a project review

- Buyback discontinuation as the board shifts entirely to dividends

Year-to-date, Barrick shares are up ~45% from December 2025 lows around $34, benefiting from rising gold prices and the Mali resolution.

What Did Management Guide?

2026 Production Guidance

Gold production will be weighted 45% H1 / 55% H2, with the second half boost coming from Loulo-Gounkoto ramp-up and Goldrush development. Copper production is expected highest in Q2-Q3, lowest in Q1 due to mine plan sequencing.

Management indicated costs are expected to be "flat" in the out years.

Longer-Term Outlook

CEO Mark Hill stated: "We continue to expect production uplift in 2027 and again in 2028," with growth driven by Loulo-Gounkoto ramp, Nevada improvements, and PV expansion.

What Changed From Last Quarter?

North American IPO Announced

The board has decided to prepare an IPO of Barrick's North American gold assets (primarily Nevada Gold Mines and Fourmile), targeting completion by late 2026.

Key details:

- Stake size: 10-15% minority position

- Rationale: Unlock value the board believes is "substantially undervalued within Barrick"

- Governance: Details still being worked out

CFO Shuttleworth explained: "By doing the North American IPO, we'll be able to shine a light on that valuation, and that light will then translate into a re-rate for all Barrick shareholders."

New Dividend Policy

Barrick adopted a new capital return framework:

The shift to dividends from buybacks drew mixed analyst reaction. CFO Shuttleworth acknowledged: "I know you're never going to please everyone, because some people favor dividends and some favor buybacks. But for now, the board is very focused on dividends."

Mali Resolution

Barrick regained operational control of Loulo-Gounkoto on December 16, 2025 after resolving the dispute with Mali's government and securing release of detained employees.

- 2026 guidance: 260,000-290,000 ounces attributable

- Ramp-up plan: All three underground mines restarted; open pit expected to resume H2 2026

- Sale prospects: "At this point, the focus is really on ramping up that mine and restoring the relationship."

Key Management Quotes

On Nevada Performance: "The Carlin Roaster had its highest January throughput in the last five years... the new management team and the focus on operational discipline, the processing team at Carlin has delivered its best 60 days since the formation of the joint venture." — CEO Mark Hill

On Reko Diq: "The board and the management are a little concerned about the security situation on the ground in Balochistan, where there's been some escalation in security events there... we've indicated to the lending consortium that we need to complete that before we can close the financing." — CFO Graeme Shuttleworth

On Record Results: "When you consider our gold sales volume declined 13% in 2025, with one of our key assets not operating for most of the year, those results are even more impressive, and we're excited about the year ahead." — CFO Graeme Shuttleworth

Operational Highlights

Nevada (NGM)

- Q4 Performance: Gold production +11% QoQ, led by Carlin +25%

- Mine Plan Rebuild: Management rebuilt plans "from the bottom up, based on achievable metrics" after top-down targets caused execution issues

- Talent Retention: Adjusting remuneration framework; simplifying bonus structure to focus on safety, production, costs, growth

- 2026 Outlook: Carlin and Turquoise Ridge production expected marginally lower due to open pit sequencing

Pueblo Viejo (PV)

- Recovery Issues: Plant recoveries running 75-76%, targeting 84% over time (down from 90% feasibility study target)

- Root Cause: Metallurgical inconsistency in 90M tons of weathered stockpiles; lab results not replicating in plant

- Updated 43-101: Coming end of February with revised recovery model; life extended to 2048 with total output maintained

Lumwana (Copper)

- Q4: Production +11% QoQ on higher throughput; record annual production

- Super Pit Expansion: Tracking slightly ahead of schedule; mill building on critical path

Risks and Concerns

-

Reko Diq Uncertainty: Security concerns in Balochistan have paused the financing process. Management stated "all options" are being reviewed, though divestiture was not confirmed.

-

Safety Fatalities: Four fatalities in 2025, with CEO Hill acknowledging "Q4 wasn't where we needed it to be" and making safety the #1 focus for 2026.

-

PV Recovery Challenges: The gap between lab and plant recoveries on weathered stockpiles represents execution risk through 2028.

-

Nevada JV Considerations: When asked about Newmont's rights under the JV agreement regarding ownership changes, management noted they are "very well aware of all the legal contracts" and "would always honor and respect those."

Q&A Highlights

On IPO Strategic Rationale (UBS): Why partial IPO vs. full spin?

"The board has gone through a lot of different permutations... they feel that this is the best opportunity that's gonna drive value uplift for shareholders."

On Veladero Sale (Bank of America): Is Veladero non-core?

"No, Veladero is not non-core, and in fact it's one of our top performing assets in the last 12 months."

On IPO Timing (Canaccord): Why IPO now with Nevada production declining?

"I think Nevada is stabilized... we have given control back to the general manager. We have a very strong team in Nevada... you've seen the performance in Q4, and January is even stronger. The best January we've had in 5 years."

Reserves and Resources

Source: Company disclosure

Reserve prices: Gold $1,500/oz, Copper $3.25/lb (modestly higher than prior year).

Leadership Transition

- CFO Graeme Shuttleworth retiring after 7 years; Q4 2025 was his final earnings call

- Helen Cai joining as CFO on March 1, 2026

- Tim Cribb moved from Reko Diq to lead North America operations

- Megan Tibbles added as Chief Technical Officer

Forward Catalysts

For the full earnings call transcript, see Barrick Q4 2025 Transcript.

View more on Barrick Gold.